Economic scenario/FETCO survey

Economic scenario/FETCO survey

Editorial staff

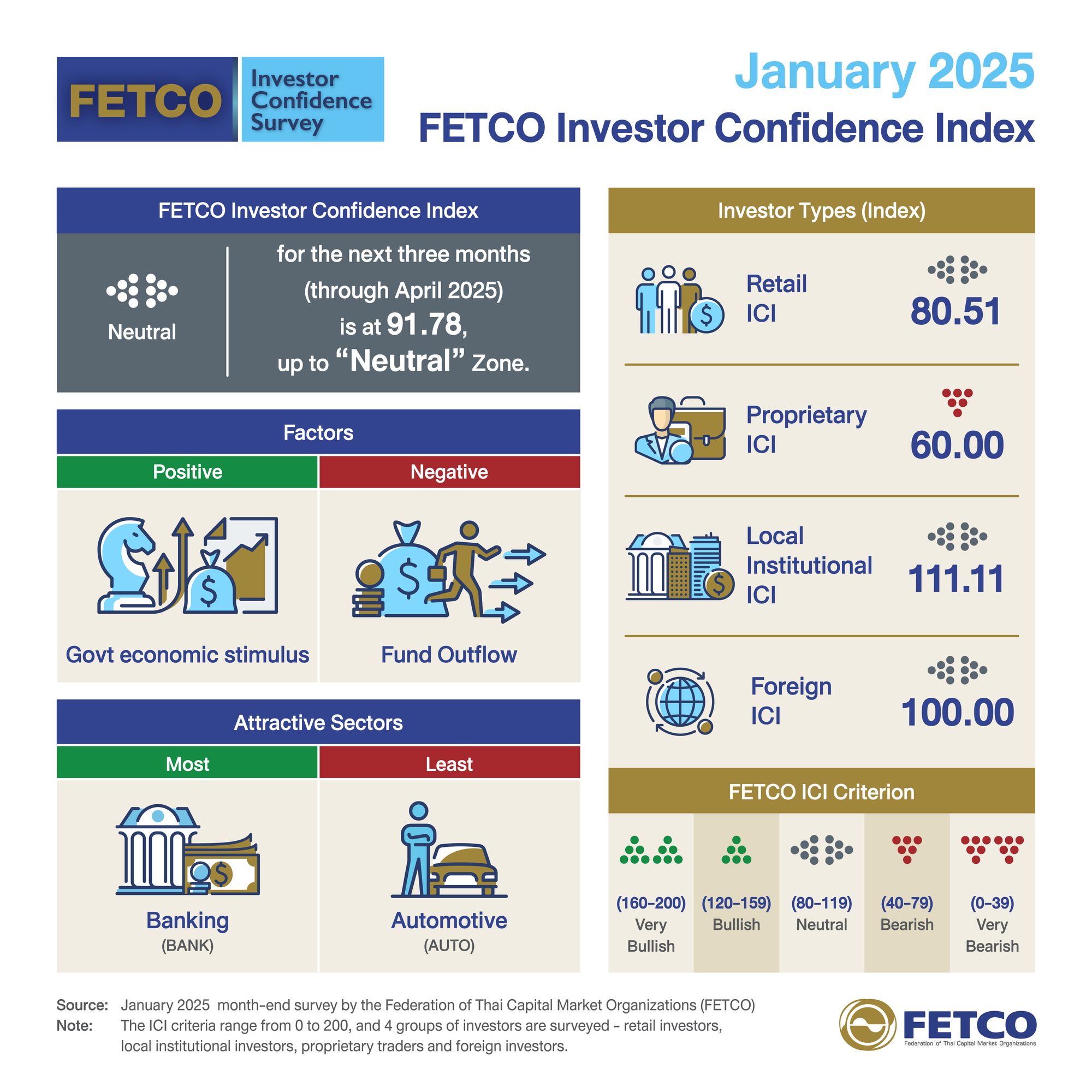

The Federation of Thai Capital Market Organizations (FETCO) reported a survey showed fund outflow, local economic slowdown and China’s economic situation are top three dampening investor confidence.

Kobsak Pootrakool, FETCO’s chairman, said that the FETCO Investor Confidence Index (FETCO ICI) in January 2025, conducted during January 20-31, which anticipated the market condition over the next three months, rises slight to ‘neutral’ zone at 91.78. The government’s stimulus packet is the most supportive factor, followed by listed firms’ earning results and fund inflow. In the meantime, fund outflow, local economic slowdown and China’s economic situation are top three dampening confidence.

Kobsak Pootrakool

Highlights of FETCO Investor Confidence Index surveyed in January 2025 are overall FETCO Investor Confidence index for the next three months (April 2025) is in the “neutral” zone (80-119 of FETCO ICI Criterion) at 91.78.

Confidence of retail investors, institutional investors and foreign investors is in the “neutral” zone while that of proprietary is in the “bearish” zone. Most attractive sector is banking (bank).

Least attractive sector to investors is automobiles (auto). Most influential factor driving the Thai stock market is the government stimulus package. Most important factor impeding the Thai stock market is fund outflow.

“The survey results in January 2025 showed that confidence of retail investor was down 6.1 % to 80.51, proprietary investors down 14.3 % to 60.00, institutional investors up 42.9 % to 111.11 and foreign investors up 33.3 % to 100.00.”

In January, SET Index headed south throughout the month, pressured by matured LTF redemption, foreign investor’s continued sell-off and worries over international trade and investment following an anticipation on the U.S. tariff policy. At month-end, SET Index closed at 1,314.50, down 6.1 % from the previous month with an average daily trading value of 39 billion baht. Foreign investors were net sellers of 11.50 billion baht.

External factors to monitor include U.S. trade war against Canada, Mexico, and China, which will take effect in February 2025. This may impact inflation and Fed’s policy cut decision while political uncertainty in France and Germany may push European economy into recession. Eyes are also on how the Chinese government’s capital market stimulus would yield results following the government’s plan to encourage insurers and funds to increase their investment in Chinese stock market over the next three years.

Locally, investors follow domestic consumption growth following the government’s stimulus package, public investment direction, trend of policy rate cut by the Bank of Thailand’s Monetary Policy Committee and earnings results of listed companies.

11 February 2025

Viewed 135 time

EN

EN