Investment/ BOI

Investment/ BOI

Chatrudee Theparat

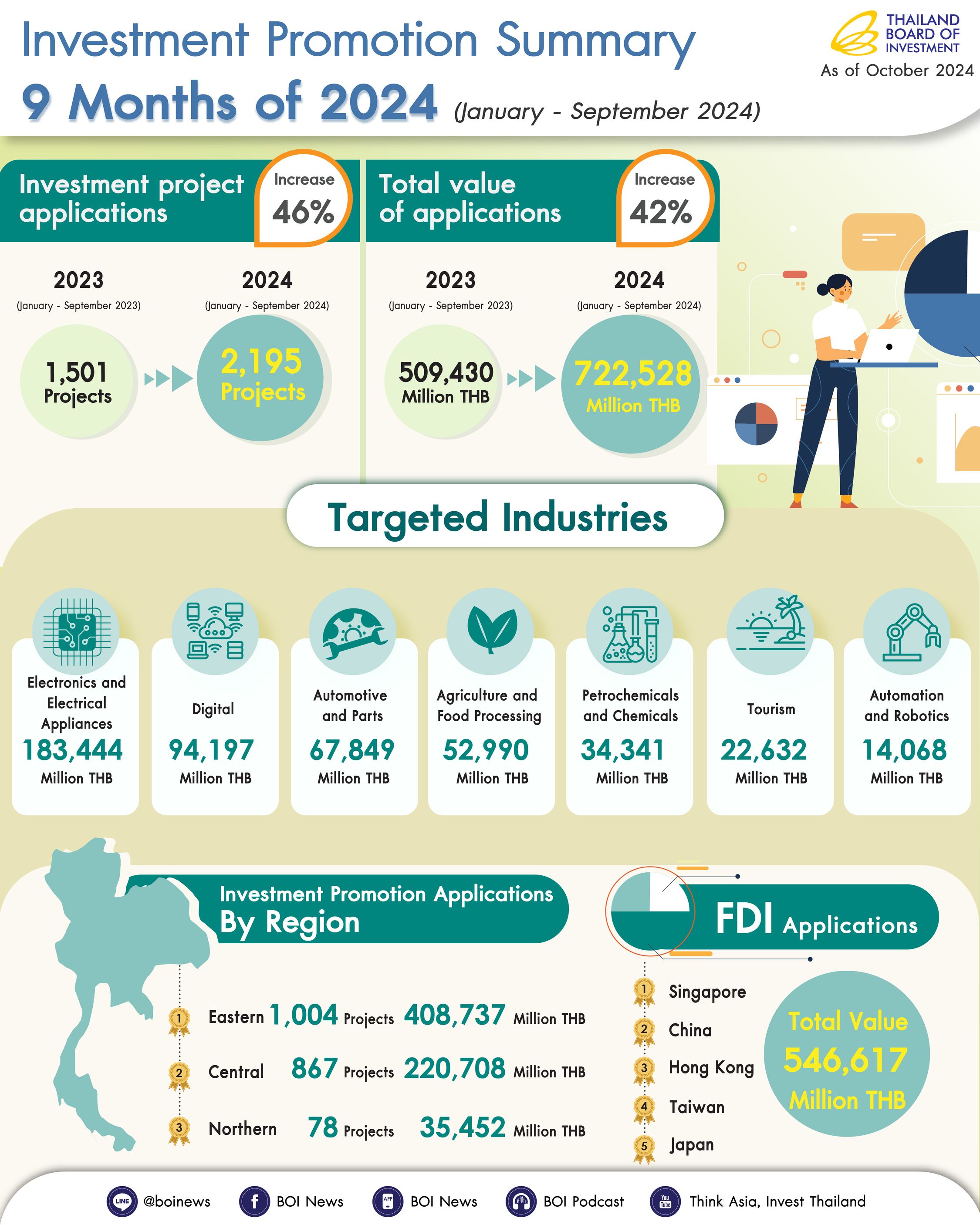

Applications for investment promotion in the first nine months of 2024 (Jan-Sept) increased 42% in value to a combined 722.5 billion baht (about US$ 21.7 billion), the highest level since 2015, according to the Thailand Board of Investment (BOI).

Large projects in targeted sectors such as electrical appliances and electronics (E&E), and digital, mostly data centers, led the rankings due to a significant influx of foreign direct investments (FDI).

The number of applications for investment promotion during the period increased 46% to 2,195 projects, from 1,501 projects in the same period of 2023. The adjusted investment value of the projects applied in the first nine months of 2023 was 509.4 billion baht.

The rising confidence of investors in key tech industries

“The investment applications in the first nine months clearly demonstrate the rising confidence of investors in key tech industries that Thailand is the strategically located, safe and resilient place that’s best for their business,” said Narit Therdsteerasukdi, secretary general of the BOI. “Thailand’s robust digital infrastructure, clean energy resources, and strong government support are providing the right environment for data center and advanced technology investment, including wafer manufacturing.”

Narit Therdsteerasukdi

The applications for projects in targeted industries accounted for 68% of the total investment value, led by the E&E sector with 291 projects worth a combined 183.4 billion baht, followed by the digital sector with 107 projects worth 94.2 billion baht, and the automotive and parts sector with 212 projects worth 67.8 billion baht. The agriculture and food processing sector saw 226 projects worth a combined value of 53 billion baht, while there were a total of 162 petrochemicals and chemicals projects with a combined value of 34.3 billion baht.

FDI projects increased by 66%

Foreign Direct Investment (FDI) during the nine months of 1,449 projects increased 66% from the year earlier period to 546.6 billion baht, an increase of 38%.

Singapore was the top source of FDI with applications worth 180.8 billion baht, more than twice the 79.7 billion seen in the year earlier period, mostly due to large investments in E&E and data centers by units of Chinese and American companies. China ranked second with 114.1 billion baht, up 18% from 96.5 billion baht a year earlier, and was followed by applications from companies based in Hong Kong (68.2 billion baht), Taiwan (44.6 billion baht), and Japan (35.5 billion baht).

E&E applications so far this year have included the 11.5 billion baht investment by FT1 Corporation, a Thailand-Hong Kong-Singapore wafer manufacturing joint venture between Hana Microelectronics and PTT Group that will start producing silicon carbide wafers as early as the first quarter of 2027.

Several printed circuit board (PCB) applications were also filed this year, such as China-based Multi-Fineline Electronics’ project to invest 13.9 billion baht to manufacture multilayer PCBs and flexible PCBs in Thailand.

Electrical appliance project applications filed so far this year include China’s Haier Appliance Manufacturing’s 13.5 billion baht investment in a new smart air conditioners manufacturing facility, and Taipei-based Inventec Electronics’ investment of 11.8 billion baht for the manufacturing of smart electrical appliances and smart electronic devices, including PCBA, notebooks, docking stations.

As for the digital sector, there were eight projects worth 92.76 billion baht. Most of the investment value came from applications to set up large data centers by units of large tech and cloud service companies such as Google (Alphabet) from the U.S., Australia’s NextDC, and India’s CtrlS Datacenters.

Electronics applications included 15 projects worth 19.85 billion baht comprising of wafer manufacturing, electronics design, assembling and testing of semiconductors and circuit. PCB and raw materials for PCB with 55 projects worth 61.30 billion baht. Smart electronics and smart electrical appliances with 13 projects worth 38.97 billion baht. Machinery and components, automation and high precision machinery were 117 projects worth 30.51 billion baht. Renewal energy with 351 projects worth 83.37 billion baht.

Automotive sector applications include Continental AG group’s Continental Tyres (Thailand) Co project to spend a total of 13.4 billion baht to expand its tire plant in Rayong province and boost annual production by an additional 3 million high-performance radial tires, mostly for export, reaffirming Thailand’s status as the World’s second largest tire production base, and Southeast Asia’s automotive hub.

21 October 2024

Viewed 168 time

EN

EN