Macroeconomics/ FTI

Macroeconomics/ FTI

Editorial staff

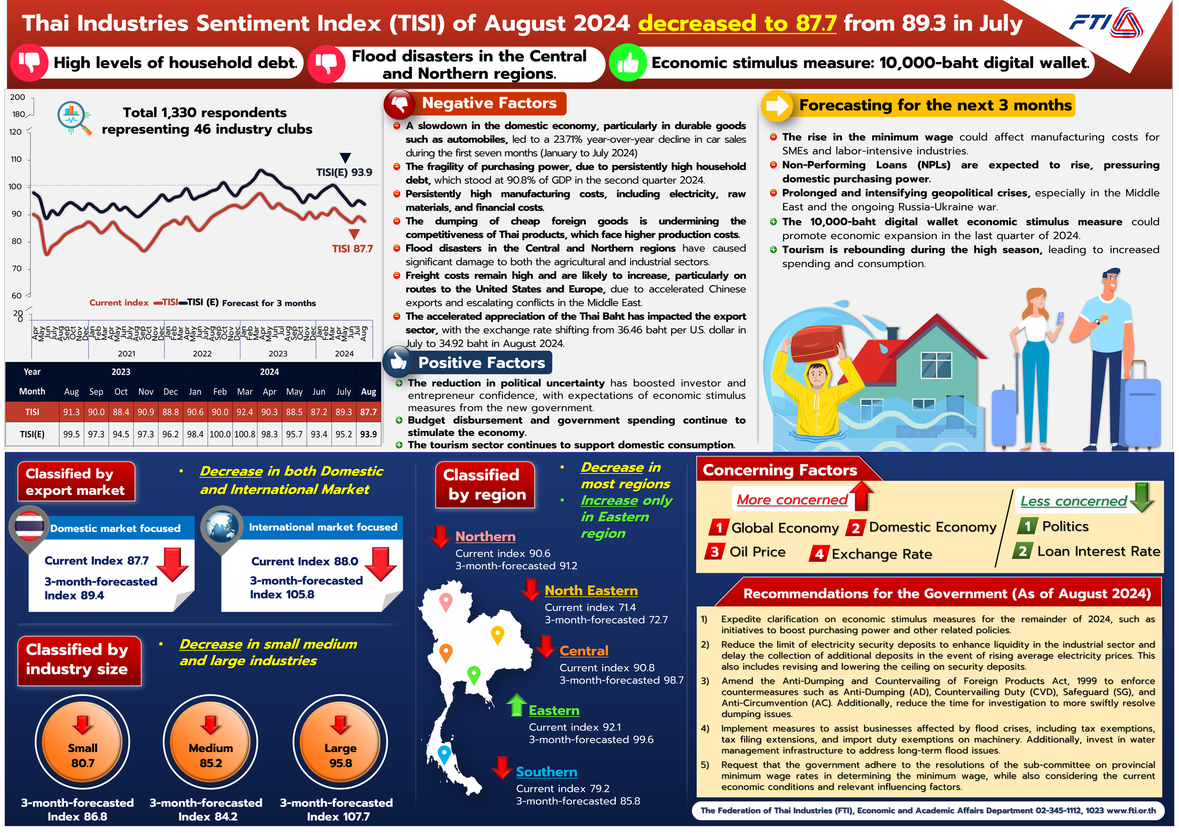

Flood disasters drive down TISI Index while TISI for August 2024 was at 87.7 decreased from 89.3 in July 2024, the TISI forecast for the next three months is 93.9, down from 95.2 in July 2024.

Kriengkrai Thiennukul, chairman of the Federation of Thai Industries (FTI), and Pipope Chokvathana, executive board of FTI and vice chairman of Economic and Academic Affairs, said that the Thailand Industry Sentiment Index (TISI) for August 2024 was at 87.7 decreased from 89.3 in July 2024.

Negative factors: slowdown in domestic demand, flood

Mr Kriengkrai said this decline is attributed to negative factors, including a slowdown in domestic demand, particularly for durable goods such as automobiles. This is reflected in the domestic car sales data for the first seven months of 2024 (January–July), which show a total of 354,421 vehicles sold, a contraction of 23.71%, particularly for pickup trucks and freight vehicles.

The slowdown is due to stringent credit policies by financial institutions and concerns over household debt, which reached 90.8% of GDP in Q2 2024, impacting domestic consumption. Additionally, businesses are facing high production costs, including electricity, raw materials, and financial costs, which pose challenges to operations. The influx of cheap foreign goods has also hindered the competitiveness of Thai products due to higher costs, resulting in a decline in sales.

Furthermore, flooding problems in the northern and central regions have damaged the agriculture and industry sectors and led to a slowdown in the construction sector.

Freight rates remain high

On the export side, freight rates remain high and are expected to increase, especially on routes to the United States and Europe. This is due to accelerated exports from China and the escalating conflict in the Middle East. At the same time, the Thai baht has rapidly appreciated from 36.46 baht per US dollar in July 2024 to 34.92 baht per US dollar in August 2024, leading to higher prices for Thai goods compared to competitors and resulting in decrease of Thailand’s competitiveness.

Positive factors in August

However, there were positive factors in August from the easing of the political situation, which increased investor and business confidence and raised expectations on economic stimulus measures to be imposed by the new government. Additionally, budget disbursements and government spending are expected to continue boosting the economy (as of the end of August 2024, 81.6% of the 2024 budget had been disbursed). The tourism sector remains to support domestic consumption through government initiatives to attract tourists. This is reflected in the number of foreign tourists for the first eight months of 2024 (January–August), totaling 23,567,850, marking a 31% YoY increase and generating revenue of 1,107.985 billion baht for the country.

According to the TISI survey conducted in August 2024, responses from 1,330 entrepreneurs representing 46 industry clubs of the Federation of Thai Industries revealed the rising concerns which include global economy (67.5%), domestic economy (65.2%), oil prices (61.3%), and exchange rate of the Thai baht against the USD from the exporter's perspective (40.6%). Conversely, the factors causing lesser concern include domestic politics (56.0 percent), loan interest rates (45.8%), respectively.

Next three months: TISI forecast, down from this July

The TISI forecast for the next three months is 93.9, down from 95.2 in July 2024. Due to factors such as the increase in the minimum wage policy to 400 baht per day nationwide, which directly affects production costs, especially for SMEs and labor-intensive industries, the situation remains challenging.

Moreover, the trend of non-performing loans (NPLs) continues to rise, as does the ongoing and escalating geopolitical situation. Nevertheless, the 10,000 baht-economic stimulus scheme will be a supportive factor together with the reviving tourism industry during the tourism season in the last quarter of 2024.

18 September 2024

Viewed 146 time

EN

EN