mai/Maruko listing

mai/Maruko listing

Editorial staff

The Market for Alternative Investment (mai) will list Maguro Group Plc, a premium-mass restaurant operator under brands "MAGURO," on June 5, 2024 under the symbol "MAGURO".

The company has a market capitalization at its initial public offering (IPO) of two billion baht (approx. USD 54.2 million).

mai President Prapan Charoenprawatt said MAGURO will start trading on mai in the Agro & Food Industry group.

MAGURO operates a restaurant business, offering food and beverage, and food delivery services as well as off-site catering. The company has three brands with a total of 27 branches covering areas in Bangkok and its vicinity; namely,

1) MAGURO, a Japanese restaurant and sushi bar that started operation in 2015 with 14 branches, as well as food delivery services through the MAGURO Go platform

2) SSAMTHING TOGETHER, a premium Korean barbecue restaurant that opened in 2021 with six branches

3) HITORI SHABU, an authentic Japanese-style shabu and sukiyaki restaurant that opened in 2022 with seven branches.

The company has a central kitchen located at Soi Chalermprakiat Rama 9, Prawet District in Bangkok.

In the first quarter of 2024, the company's revenue by restaurant brand was MAGURO : HITORI SHABU : SSAMTHING TOGETHER at a ratio of 58:25 : 17, respectively.

MAGURO has a paid-up capital after the IPO of 63 million baht, consisting of 104.54 million existing ordinary shares and 21.46 million newly issued shares, with a par value of 0.50 baht per share.

Of the total IPO shares comprising 21.46 million newly issued shares and 12.6 million shares held by existing shareholders, 32.78 million shares were offered to persons at the underwriters' discretion, 0.62 million shares to the company's patrons, and 0.66 million shares to the company’s directors, executives, and employees during May 28-30, 2024.

The IPO shares were priced at 15.90 baht per share, raising 341.22 million baht in fresh fund and 541.56 million baht in total issued value. The IPO price was equivalent to the price-to-earnings (P/E) ratio of 27.38 times.

The earnings per share is equal to 0.58 baht which was calculated from the company’s net profit over the past 12 months (from April 1, 2023 to March 31, 2024) divided by fully diluted shares. Jay Capital Advisory Co., Ltd. is the financial advisor, and Finansia Syrus Securities pcl is the lead underwriter.

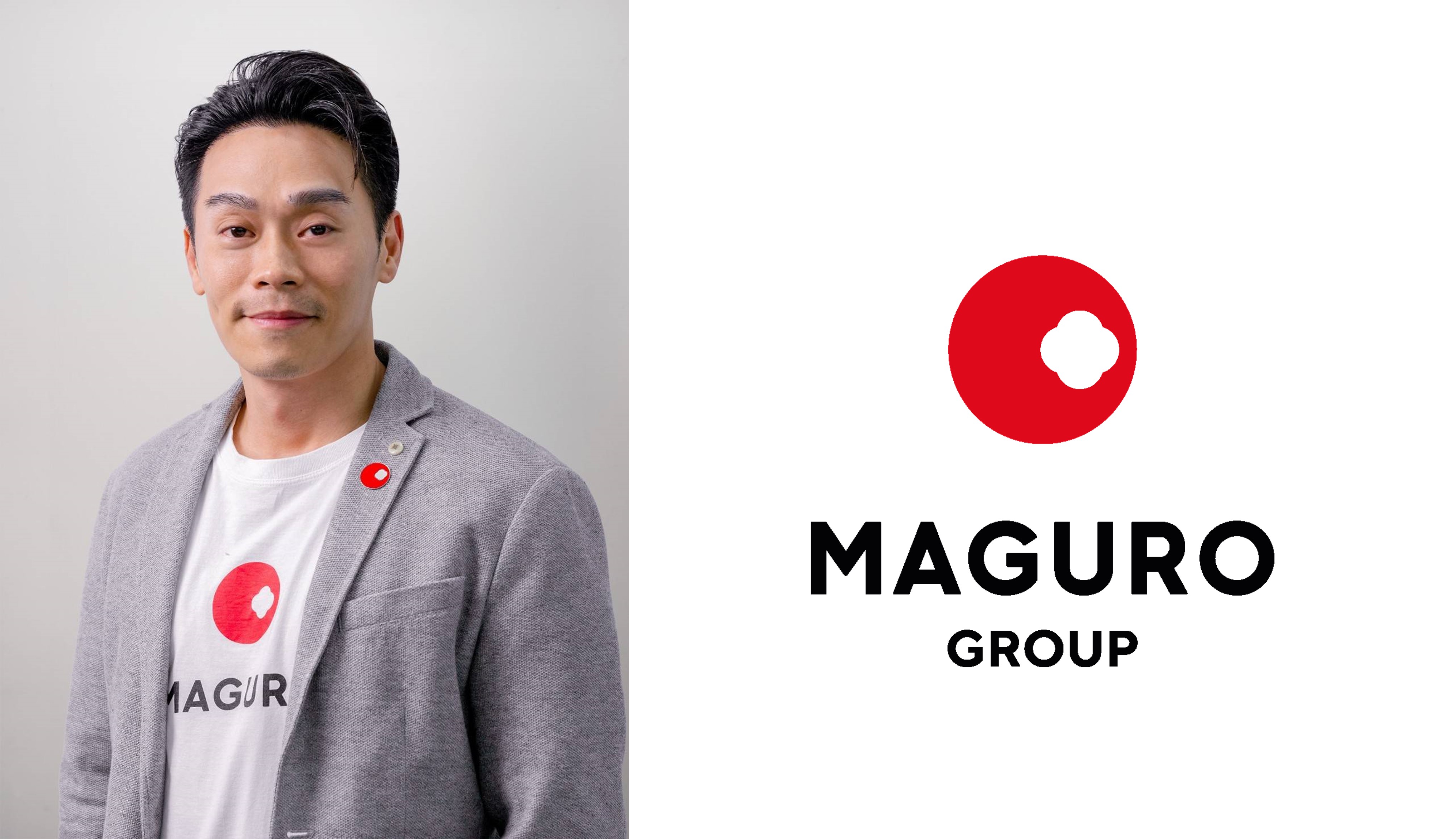

MAGURO chief executive officer Eakkalurk Sangsareedumrong said that the company's restaurant business has been adhering to the Japanese philosophy of "Give More. This is the starting point for operating a premium-mass restaurant business to deliver valuable and quality dining experiences to customers.

The proceeds from the fundraising will be used to expand the company's business, renovate existing branches and the central kitchen, install and upgrade IT systems related to operations to increase work efficiency and support future branch expansion, and as working capital.

MAGURO's major shareholders after IPO are the four founders, consisting of Eakkalurk Sangsareedumrong, Chatcharas Sriarun, Ronnakad Chinsamran, and Jakkrit Saisomboon, (14.86 % each); and Holistic Impact Pte. Ltd, a private equity fund, (13.52 %). The company’s dividend policy is to pay shareholders not less than 40 % of net profit from its financial statements after taxes and legal reserves.

04 June 2024

Viewed 130 time

EN

EN