Macroeconomics/inflation

Macroeconomics/inflation

Editorial stafff

The headline inflation is expected to increase in the second quarter of this year.

The headline inflation is expected to increase in the second quarter of this year because an increase of oil price, depreciation of baht, and uptrend tourism.

Poonpong Naiyanapakorn, the director of Trade Policy and Strategy Office, said the headline inflation is expected to increase in the second quarter of this year, mainly due to the major factors including the price of crude oil in the global market tends to increase.

Poonpong Naiyanapakorn

The exchange rate tends to depreciate, falling lower than the first quarter of this year and the same period in 2023, the lower base price of electricity resulted from the government measures in previous year, particularly in May 2023, will contribute to an increase in the inflation rate. The continuous expansion of tourism will result in higher prices of related goods and services.

However, there are some other factors possibly maintaining low inflation rate. For instance, the high base prices of pork and fresh vegetables, combined with the gradual trend in price rise this year due a large amount of supply in the market, will result in a low inflation rate.

In addition, Thailand's economy has expanded very slowly, and tend to expand at a slower rate than its previous prediction earlier this year. The intense competition among large-scale

wholesale and retail traders, along with the growth of e-commerce, has led to the adoption of extensive trade promotion policies, particularly continuous price reductions.

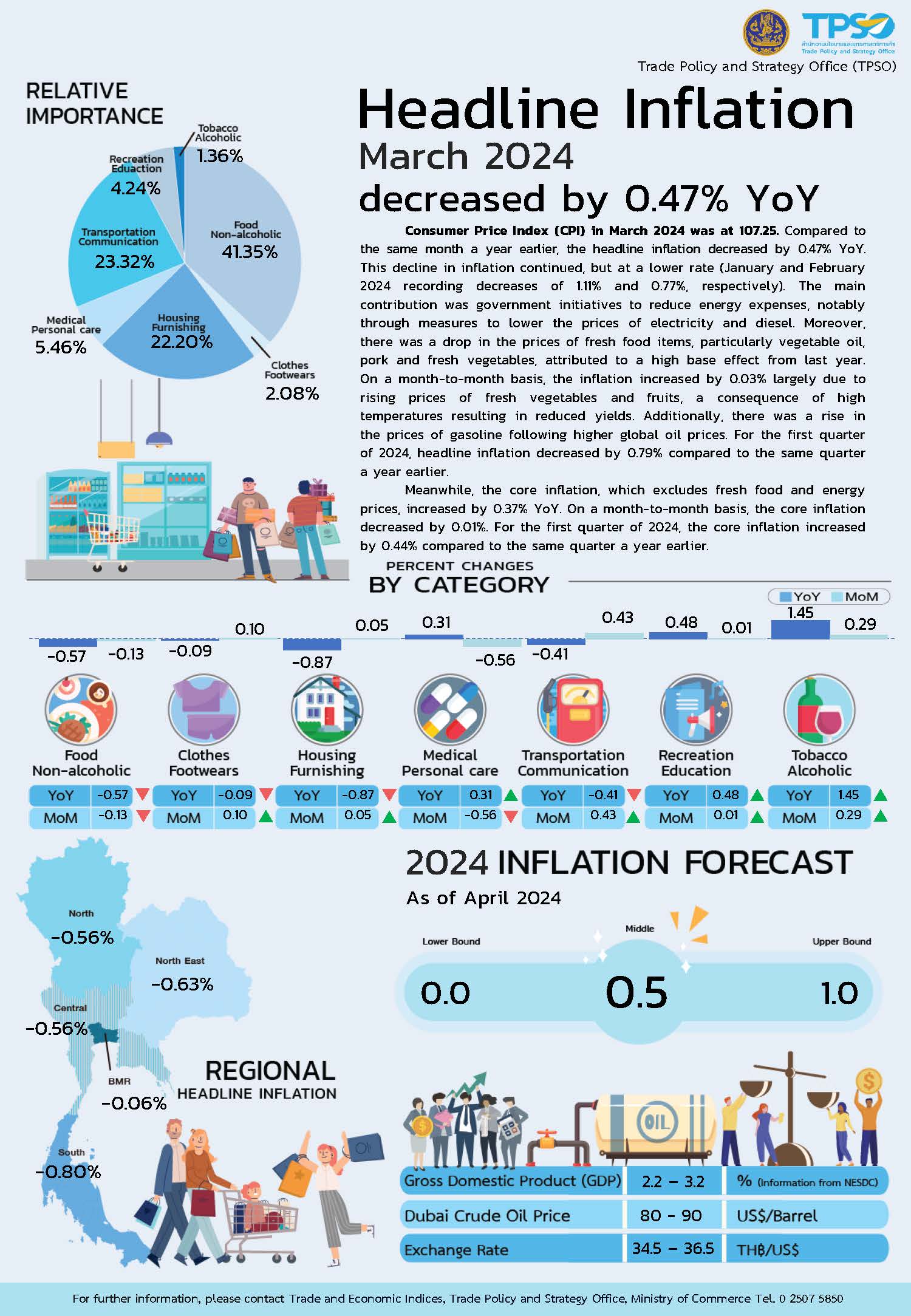

He said the ministry has adjusted the prediction of the headline inflation for 2024, from between (–0.3) % and 1.7% (midpoint of 0.7%), to between (0.0) % and 1.0% (midpoint of 0.5%). This rate aligns with the current economic situation. If there are significant changes in the circumstances, there will be a reconsideration made by Trade Policy and Strategy Office.

The overall consumer confidence index for March 2024 slightly decreased from 54.2 in February 2024 to 54.1, but still above the confidence for 16 consecutive months (since December 2022).

The present index decreased from 46.4 in February to 46.1, while the future

(3-month outlook) was 59.5, which was the same as the previous month. The consumer confidence index still remained within the confidence range presumably due to the recovery of Thailand’s economy, especially the continuous expansion of the tourism and export sectors. The increasing prices of key agricultural products, such as rice and natural rubber, also play an important role in remaining the consumer confidence.

Nevertheless, there are some risks from external factors that may impact Thailand’s economy. Additionally, there are concerns of the public regarding debt burdens and decreased purchasing power. This may lead to a gradual change in the consumer confidence index.

The headline inflation decreased by 0.47% (YoY) because of a decrease in the prices of fresh food, especially meat and fresh vegetables.

The Consumer Price Index (CPI) in March 2024 was 107.25 comparing to March 2023 (107.76), the headline inflation decreased by 0.47% (YoY) because a decrease in the prices of fresh food, especially meat and fresh vegetables, caused by an increase in the market supply.

Moreover, the high base price in March 2023 has contributed to the decrease in the inflation rate. Due to the government measures, the prices of electricity and diesel fuel were also lower compared to the same period in 2023. The headline inflation rate in March 2024, which decreased by 0.47% (YoY), was contributed by the prices of goods and services, food and non-alcoholic beverages category decreased by 0.57% (YoY), driven by falling prices, non - food and beverages category decreased by 0.40% (YoY), primarily due to the ongoing government measures that lowered the prices of electricity and diesel fuel compared to March 2023.

For the core inflation, excluding fresh food and energy, it increased by 0.37% (YoY) with a slight decrease from 0.43% (YoY) in February 2024.

05 April 2024

Viewed 133 time

EN

EN