Thailand’s 2004 real estate industry outlook

Thailand’s 2004 real estate industry outlook

Editorial staff

Thailand real estate to show ongoing resiliency in 2024

Thailand’s commercial real estate industry is poised to perform strongly in 2024, driven by the ongoing recovery in the country’s tourism market, growing manufacturing sectors, and flight-to-quality and flight-to-green movements into prime assets across core sectors.

According to JLL, a leading global commercial real estate and investment management company, Thailand’s real estate market will demonstrate resilience in the coming 12 months as an uncertain global macroeconomic environment will be offset by an array of domestic policy initiatives and domestic market confidence.

Compelling statistics in 2023 highlight the dynamism of Thailand's real estate market, including a significant year-on-year growth of 66% in investment amounts for targeted manufacturing industries. Tourist arrivals also increased by 152% compared to 2022, exceeding the government’s target, signaling a robust recovery and demand in the hospitality sector. In addition, the demand for prime office space in Bangkok's Central Business Area (CBA) remains strong, particularly among multinational companies.

"Despite facing global economic challenges, Thailand has shown remarkable potential. The commitment of policymakers to implement strategic improvements in infrastructure and the high quality of Grade A real estate in Bangkok will provide a major push for growth and provide a buffer against the combination of macroeconomic uncertainty, the high cost of capital and geopolitical factors," said Michael Glancy, country head, Jones Lang LaSalle (Thailand) Limited (JLL).

Across 2024, JLL forecasts four key growth drivers will influence Thailand’s real estate market.

Mega Project Era

Thailand and Southeast Asia’s real estate market will be influenced more in 2024 by strategic improvements in infrastructure and the quality of Grade A real estate in Bangkok. Bangkok's real estate market is set to be transformed by several world-class mixed-use development projects, with a total of 10 mixed-use precincts. These developments are expected to bring over 900,000 sqm of Grade A office space, 300,000 sqm of retail centres, 5,400 units of luxury condominiums, and 5,900 keys of luxury hotels to Bangkok's Central Business Area (CBA) by 2028. This influx of premium real estate positions Bangkok as an attractive destination for investors, multinational corporations (MNCs), and skilled labor.

Aging Buildings

With 60% of the office space in the Bangkok Metropolitan Region now older than 20 years, the upcoming premium supply poses a challenge for the competitiveness of these older assets. Proactive and creative landlords who strategically invest in their assets are outperforming both the market and their peers. It is now vital for more developers to follow suit and embrace strategic investments to prevent potential obsolescence.

According to JLL, CBA’s aged office buildings older than 10 years that have undergone major renovations have been able to maintain its rental level close to the market average. Whereas those with no renovation works continued to see tenants moving out and declining rent, resulting in a widening rental gap of 8.8%, as of 4Q23. This trend is not limited to the office market, as a flight-to-quality/flight-to-green movement is also becoming visible in the retail and logistics sectors, with potential expansion to the hotel and residential sectors.

ESG Integration

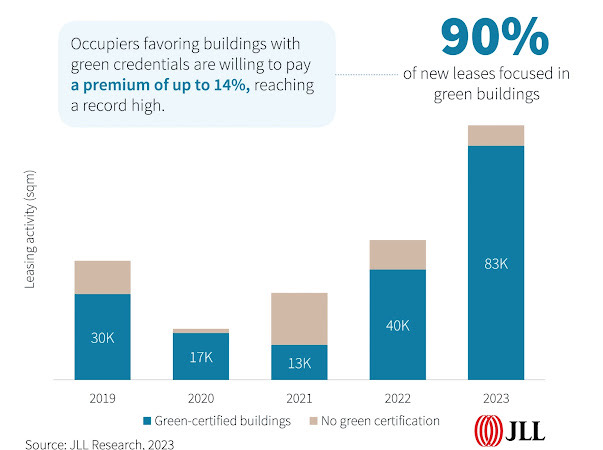

ESG has become a must have in the Bangkok office market, with developers and investors committing to meet market standards through certifications such as LEED and WELL. MNCs, as significant demand drivers for office and logistics spaces, are often required by their headquarters to occupy ESG-certified spaces. According to JLL's database, 90% of new leasing activities in the past five years were in green buildings, which can command up to a 14% premium, putting more downward pressure any older assets which have been inactive following the ESG standards.

Foreign Investment Landscape

Foreign investment is crucial to the growth of Thailand's real estate market as the industry is fueled significantly by inbound capital. Approximately 65% of existing office space is occupied by MNCs, and over 10% of condominium units transacted in Bangkok were purchased by international buyers in 2023. As Thailand has been making efforts to attract foreign investment, JLL believes that there is an opportunity to increase the countries competitiveness by considering alternatives such as offering longer leasehold periods and investment incentives for selected asset classes.

Looking ahead for the next 12 months, JLL anticipates continued growth and evolution in the Thai real estate market, driven by the key trends identified. The focus on ESG, the rejuvenation of aging assets, and the strategic approach to attract foreign investment, are expected to create a win-win scenario for all stakeholders in the real estate ecosystem.

“Over 47% of non-land transactions over the past 10 years are hotels, which is a testament to the solid investment appeal in our tourism industry and its strong fundamentals as we have seen in our speed of recovery. Thailand's evolving foreign ownership landscape will open more opportunities to foreign investors in the hospitality industry,” Rathawat Kuvijitrsuwan, senior vice president of Advisory & Asset Management, Asia, JLL Hotels & Hospitality Group, said.

Anawin Chiamprasert, head of research & consulting, Jones Lang LaSalle (Thailand) Limited (JLL), said In the face of global economic turbulence, Thailand's real estate market has not only remained steadfast, but is set to evolve across multiple asset classes, positioning Thailand as a key foreign investment destination in the Asia Pacific region.

28 February 2024

Viewed 205 time

EN

EN