Pi Securities (“Pi”) announced the successful completion

Pi Securities (“Pi”) announced the successful completion

Editorial staff

Securities secures US$10 million from Koo Family Group to fuel its ambition to become the leading regional wealth and investment platform.

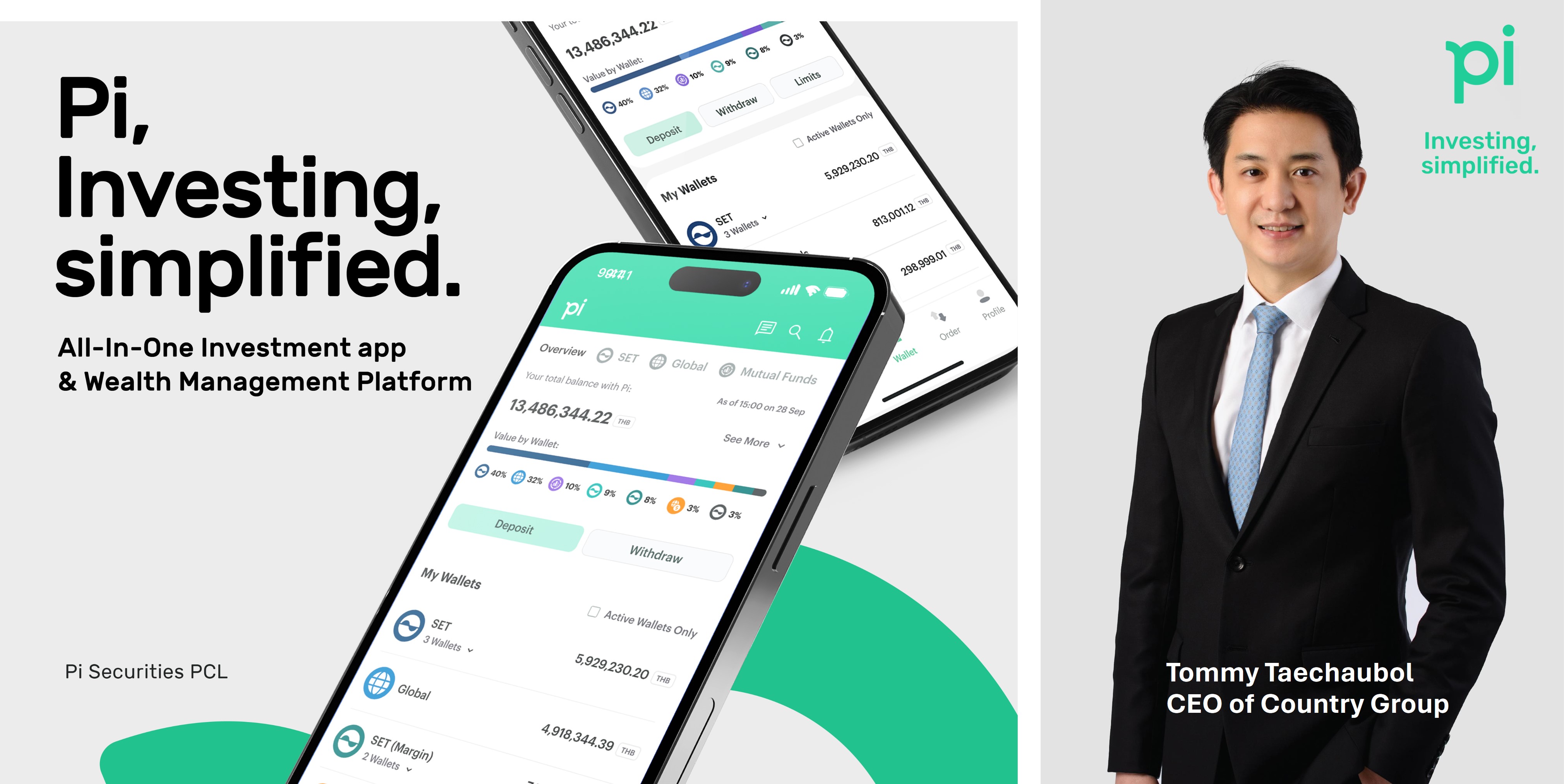

Pi Securities (“Pi”) announced the successful completion of a strategic fundraising round, securing over US$ 10 million in funding from Taiwan’s Koo family. This funding will fuel Pi's ambition to become the leading regional wealth and investment platform.

Pi Securities is currently a market leader in the trading business, processing over US$ 21 billion in equities volumes and 30 million contracts in derivatives volumes in 2022. The platform has over 80,000 clients growing at a CAGR of 16% over the past 4 years.

In 2014, Pi sold its retail business, rebuilt it from scratch, and in recent years rebranded from Country Group Securities PCL, to regain its leading market position, winning its SET TFEX Agent of Year Award for the last 4 years consecutively. With its transformation nearing completion, Pi Securities is ready to scale up its digital offering, aiming to triple its trading client base in 2024. The company is developing a multi-asset investment platform, which promises a seamless new investment experience, offering the broadest range of asset classes and markets in one application.

The Koo Family is a Taiwan-based family operating a Pan-Asian conglomerate with diverse interests in banking, insurance, real estate, hospitality, sports, and equity investments across Taiwan, USA, Japan, China, and Southeast Asian markets. The Koo’s flagship company is CTBC Financial Holdings, a global financial conglomerate with assets of over US$ 260 billion in 3Q2023. As a key strategic partner, the Koo Family, through its flagship portfolio CTBC Financial Holding, will support Pi in elevating its investment services, product development, and client service capabilities regionally.

Tommy Taechaubol, CEO of Country Group Holdings, Pi's parent company, said the Pi platform currently utilizes the best technology to provide multi asset trading services. Products on the application are carefully curated by product specialists so that the investment experience feels guided, and clients are always supported by their respective relationship managers. Pi Securities is currently also trialing its client data analytics tools which will be used directly by its investment team to monitor client’s portfolios for allocation, risk, and performance to help improve performance.

In 2024, Pi Securities plans to leverage its technology and product capabilities to launch its new Wealth Management Business. The company currently has US$ 2.7 billion of clients’ assets on platform. It expects to grow its assets under advisement by an additional US$1.2 billion in the first year, initially targeting high-net-worth clients and offering curated investment options in partnership with leading alternative global fund managers. Pi Securities is also set to digitize its wealth business, allowing existing clients to seamlessly transition to its wealth services digitally.

11 January 2024

Viewed 206 time

EN

EN