FETCO ICI in September 2023 down 20.6 %

FETCO ICI in September 2023 down 20.6 %

Editorial Staff

FETCO Investor Confidence Index (FETCO ICI) in September 2023 down 20.6 %

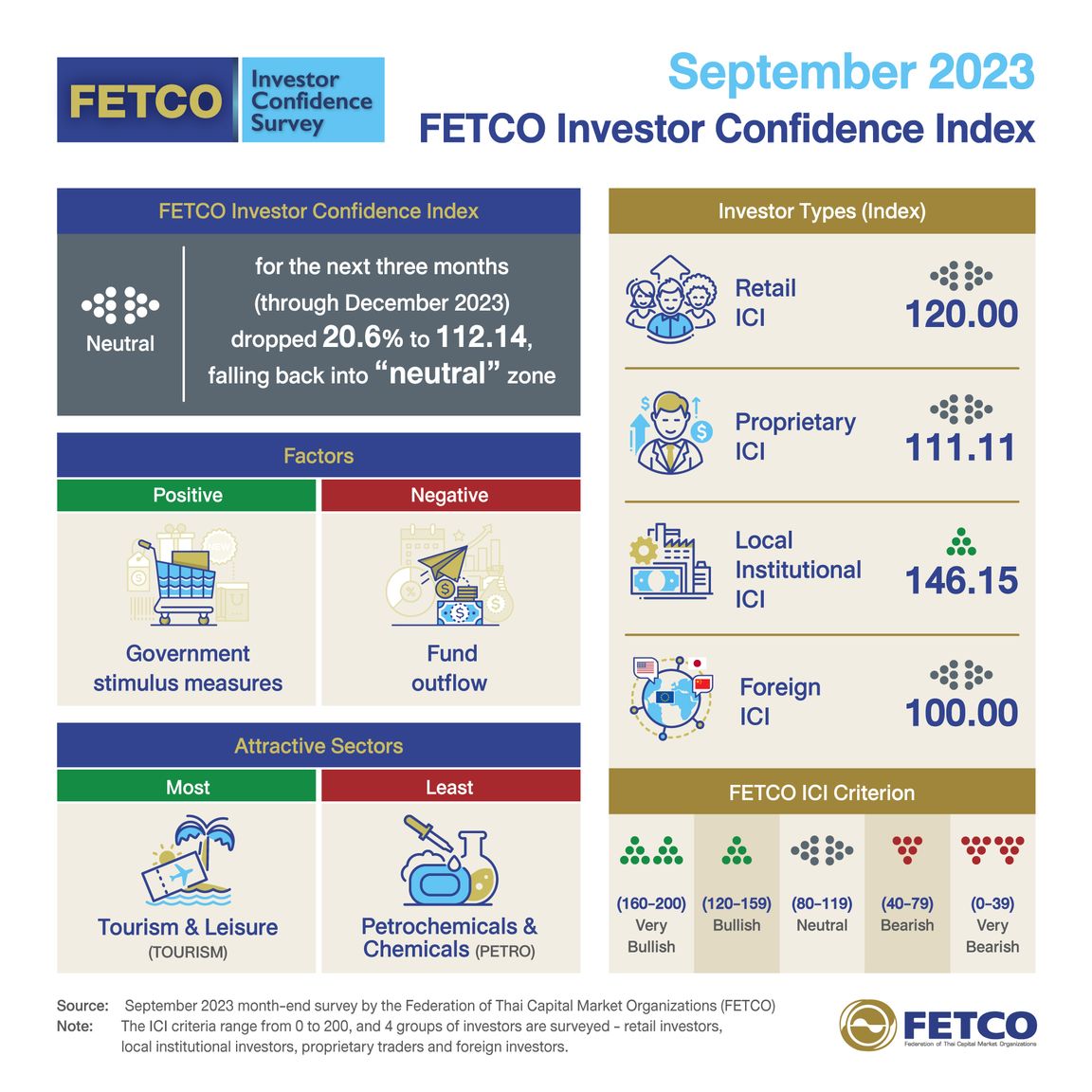

Kobsak Pootrakool, chairman of the Federation of Thai Capital Market Organizations (FETCO), revealed that the FETCO Investor Confidence Index (FETCO ICI) in September 2023 (conducted during 20-30September 2023), which anticipated the market condition over the next three months, is at 112.14, down 20.6 % from the previous month, hovering back to “neutral” zone.

Kobsak Pootrakool

Government’s economic stimulus measures are anticipated as the most supportive factor, followed by local economic recovery and expectation on fund inflow. However, fund outflow weighs on sentiment the most, followed by local economic retreat and local political situation.

Overall FETCO investor confidence index for the next three months (December 2023) is in “neutral” zone (80-119 of FETCO ICI Criterion), down 20.6 % from the previous month to 112.14.

Confidence of institutional investors is in“bullish” zone while that of retail, proprietary and foreign investors is in “neutral” zone.

“The survey results in September 2023 show that investor’s confidence across categories was weakened, retail investors down 27.3 % to 120.00, proprietary investors down 1.2 % to 111.11, institutional investors down 0.6 % to 146.15 and foreign investors down 20 % to 100.00.

SET Index headed south throughout September 2023, undermined by concerns over inflation. Oil prices shot up after OPEC and Russia announced oil production cut. Higher than expected inflation triggered the Bank of Thailand’s Monetary Policy Committee to raise its policy rate by 25 basis points to 2.50 %.

Weakened baht and the government’s measures on electricity bill and diesel price subsidy caused sell-off of securities in energy and utility sectors. At month-end, the SET Index slipped below the1,500 mark, closing at 1,471.43, down 6 % from a month earlier.

External factors to monitor include monetary measures of major central banks as inflation remains above target. China’s central bank set to boost liquidity and fund outflow from emerging markets to developed markets will be on the radar. Locally, eyes are on the government’s economic stimulus policies and measures as so far, those plans are arguably seen as a short-term push under limited budget. Investors would like to see clearer details of the 10,000 baht digital handout scheme, electricity bill and energy price subsidy, as well as debt moratorium for farmers. Impact tourism recovery is to be seen after Chinese and Kazakhstani nationals are granted a temporary visa exemption for tourism purpose. Eyes are also on liquidity increase in the Thai stock market after the Finance Ministry scrapped a plan to collect a financial transaction tax.”

06 October 2023

Viewed 162 time

EN

EN