abrdn launches new fund investing

abrdn launches new fund investing

Editorial Staff

abrdn launches new fund investing in Chinese stocks with sustainable growth potential in 5 key themes

Aberdeen Asset Management (Thailand) Limited, a subsidiary of abrdn plc, launches “abrdn China A Share Sustainable Equity Fund” (ABCA) focusing on sustainable investments in Chinese stocks with unique strengths.

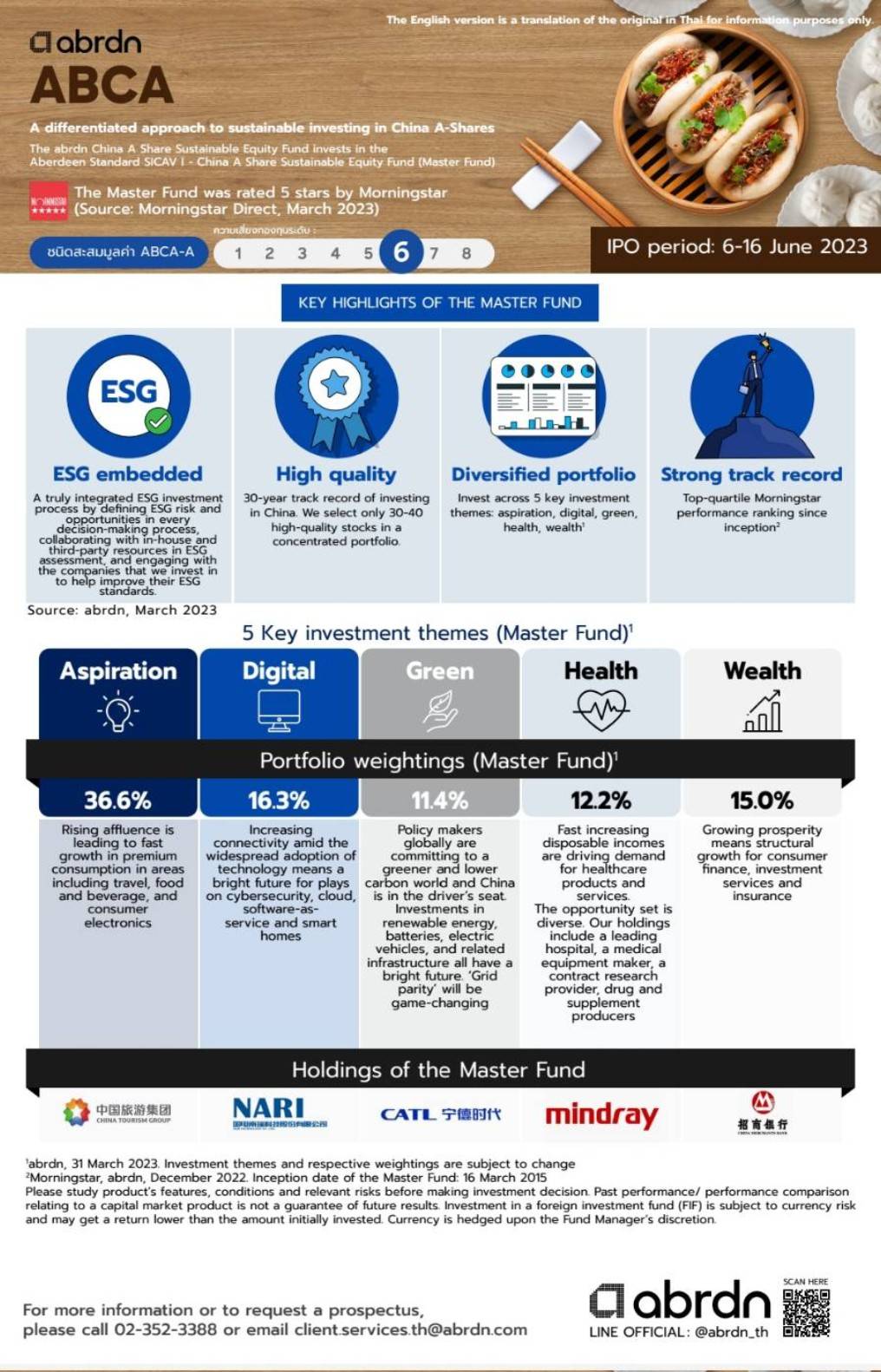

The master fund selects quality stocks with in-depth analysis, embracing ESG in the investment to support the chart-topping performance. Its investment focus is based on 5 key themes – domestic consumption, technology, clean energy, asset and wealth management, and healthcare that benefit from China's economic growth and government support policies. IPO will take place during June 6-16, 2023.

Mr. Robert Penaloza, chief executive officer of abrdnThailand, revealed that Chinese stock market is another option that investors are interested in amid concerns of a recession in developed markets such as the United States and Europe driven by higher interest rate environment. This makes the Chinese market stand out with its economy that is still growing well while the government continues to adopt an accommodative monetary policy. Moreover, fiscal policy is conducive to driving growth and helps make China's recovery more sustainable.

"abrdn recognizes that the A-Shares market is attractive due to many supporting factors, particularly China’s consumption sector that began to see a better recovery. It is expected that, in the second half of this year, the consumption sector will be the main driver for China's overall economic growth. More importantly, the valuation of China A Shares remains low, contrary to the performance of companies in the A Shares market that has started to recover. Therefore, it is an opportunity for long-term investors to invest in quality assets at attractive prices and it is also a good alternative for portfolio allocation,” said Mr. Robert.

The distinctive features of the master fund include: 1. ESG embedded: In-depth analysis of every investment process ranging from the selection of stocks into the portfolio to assessment and grading using the abrdn’s ESG criteria combined with benchmarks from other sources. More importantly, abrdn also engages in supporting companies that invest in ESG development; 2) High quality: Selecting only 30-40 quality stocks into the portfolio by a team with more than 30 years of experience in Chinese stocks; 3. Diversified portfolio: Diversification across 5 main themes, focusing on domestic consumption, technology, clean energy, asset and wealth management, and healthcare; and 4. Strong track record: Outstanding Performance from Morningstar Ranking in the top-quartile since fund inception.

Thanks to distinctive features of the master fund that positively affect the investment portfolio, as of March 2023, the debt-to-equity (D/E) ratio was negative 22%, indicating the master fund's stock selection strategy that focuses on avoiding investing in companies with debt. Meanwhile, the return on equity (ROE) ratio is higher than the benchmark reflecting high growth stocks in the portfolio but has a lower level of debt compared to the benchmark.

12 June 2023

Viewed 189 time

EN

EN