SET market report for April 2023

SET market report for April 2023

Editorial Staff

SET market report for April 2023

The impacts on Thai listed companies are very limited as their asset exposure to the troubled financial institutions is low.

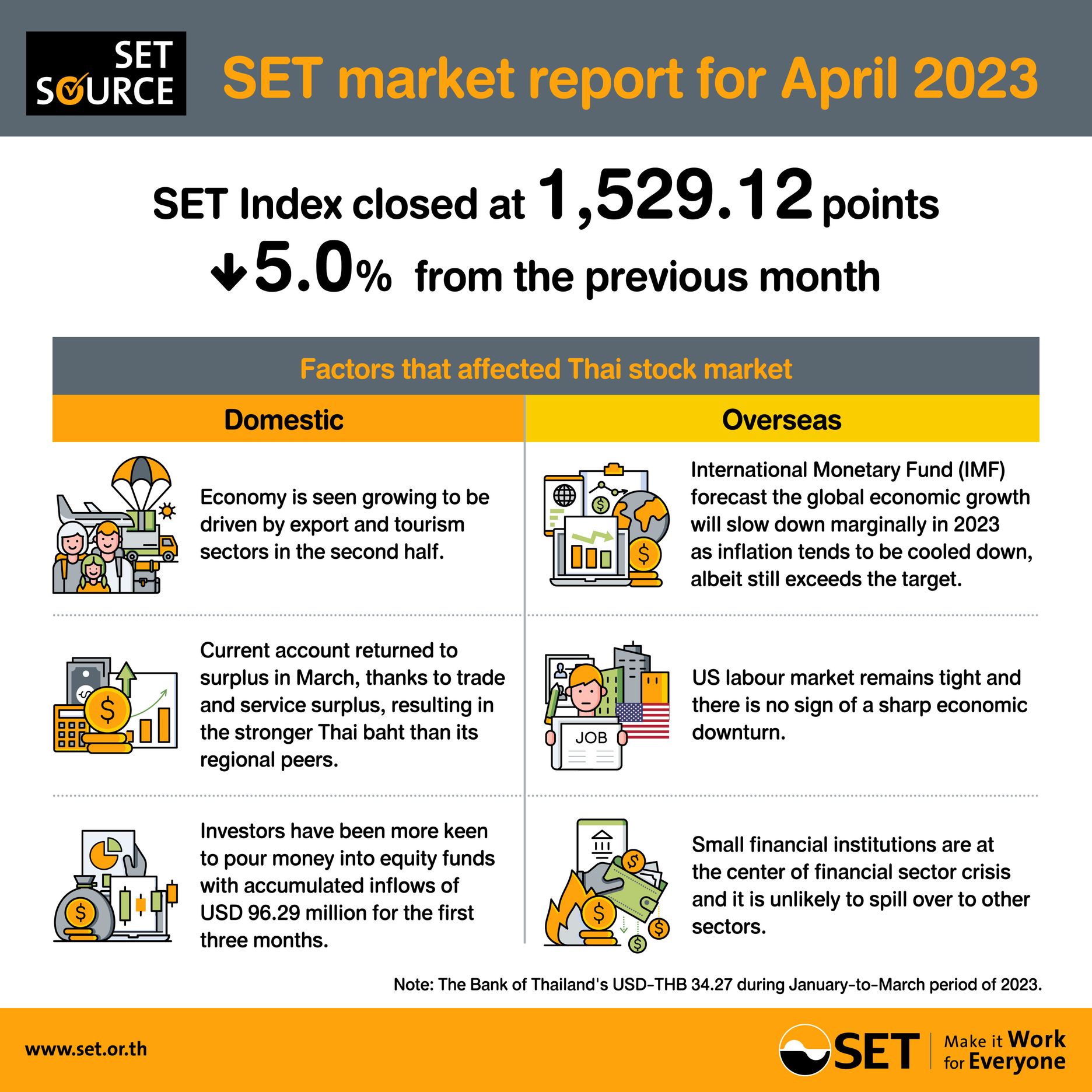

International Monetary Fund (IMF) forecast the global economic growth will slightly slow down in 2023, inflation stubbornly stays above the target as the labour market still tight as seen by the fact that the ratio of job vacancy to unemployed people hit the highest level in a decade.

However, a better balance labour market is shaping. Impacts from aggressive rate hikes by several central banks on financial sector start to be seen, shaking depositor confidence, making a run on deposits at vulnerable banks and consequently compelling government to launch assistance measures to avert a snowball effect.

Senior executive vice president of the Stock Exchange of Thailand (SET) Soraphol Tulayasathien said that capital flew out of several regional stock markets including Thailand. The Thai economic data in the most recent month suggested that export and tourism sectors set to grow in the surplus in March and beat analysts’ forecast, thanks to trade and service surplus, resulting in the firmer Thai baht than other regional peers.

At the end of April 2023, the SET Index decreased by 5% from the previous month and 8.4 % from the end of 2022 to close at 1,529.12 points, moving in the same direction as other markets in ASEAN.

The decline in SET Index made Thai equity funds (excluding tax-saving funds) appeal to investors, with the accumulated fund inflows of 3.3 billion baht (approx. USD 96.29 million) for the three months to March, the billion-baht inflows seen for the first time in three years. Moreover, super savings funds (SSFs) attracted a net inflow of 1.1 billion baht, mostly poured into equity large-cap funds, for the first three months of 2023.

In April 2023, SET’s and Market for Alternative Investment (mai)’s average daily trading value dropped 43.1 % from the same period a year before to 46.81 billion baht.

Foreign investors were net sellers for the third straight month to a tune of 7.90 billion baht in April after a four-month net buying streak. However, their trading ratio remained higher than any other types of investors for 12 straight months.

In April, there was one newly-listed company on SET: Millennium Group Corporation (Asia) pcl (MGC), and another one on mai: Pilatus Marine pcl (PLT).

The Thai stock exchange’s forward P/E ratio at the end of April 2023 was 15.0 times, above the Asian stock market’s average of 12.4 times. The historical P/E ratio stood at 18.7 times, exceeding the Asian stock market’s average of 13.9 times.

Dividend yield ratio at the end of April 2023 was 3.14 percent, below the Asian stock market’s average of 3.36 percent.

Thailand Futures Exchange (TFEX)’s daily trading volume in April averaged 402,387 contracts, down 40.7 % from the previous month largely due to the decline in trading volume of across all products, particularly SET50 Index Futures Single Stock Futures. For the first four months of 2023, TFEX’s daily trading volume declined 1.1 % over the same period last year to 559,610 contracts, mainly due to the lower trading volume of Single Stock Futures.

10 May 2023

Viewed 171 time

EN

EN