Macro Economic

Macro Economic

Editorial team

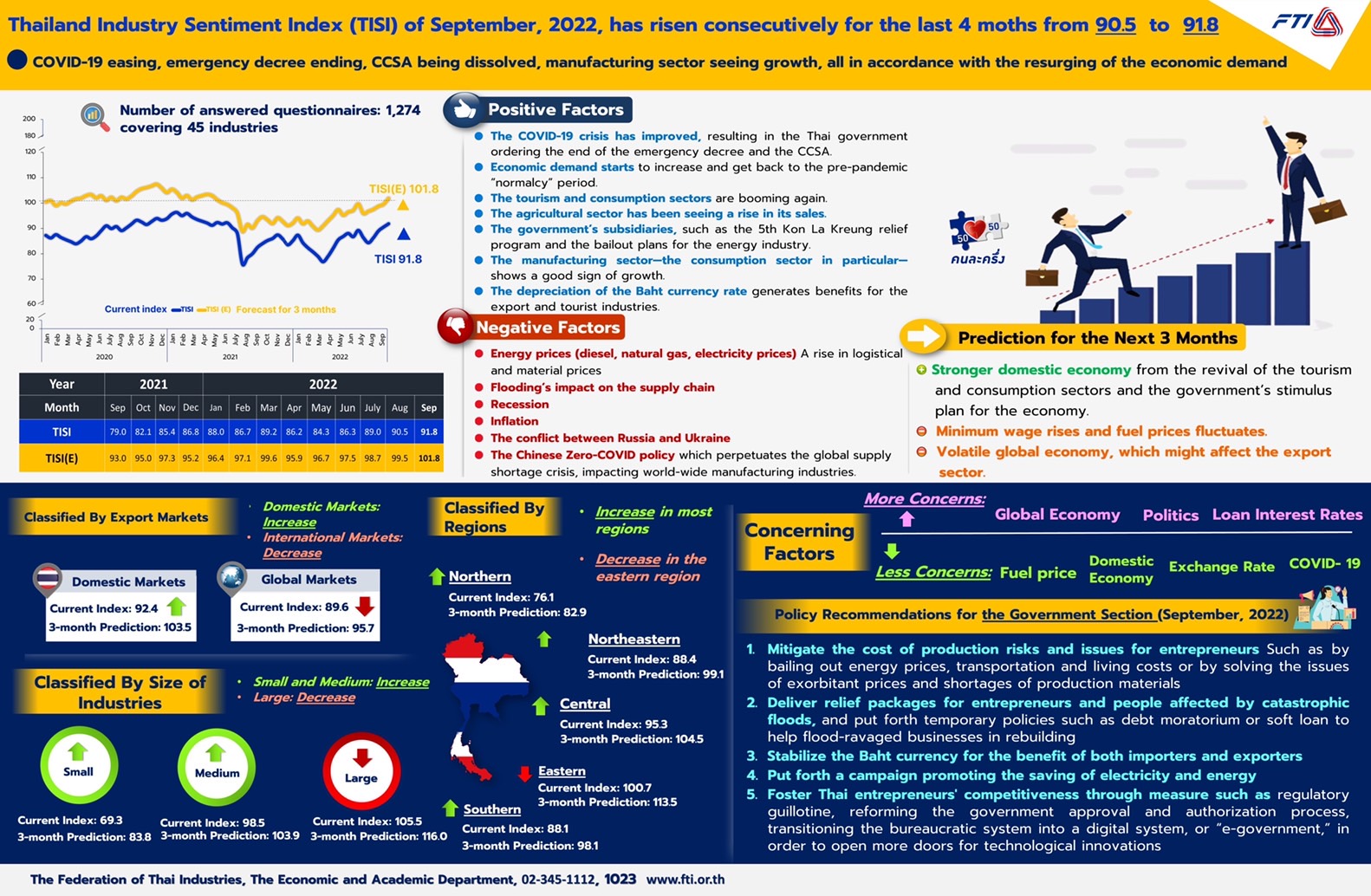

Thailand Industry Sentiment Index (TISI) was rebounded for the fourth consecutive months but concern on energy cost as its impact to production and logistic

Mr Kriengkrai Thiennukul, chairman of the Federation of Thai Industries(FTI)

Mr. Kriengkrai Thiennukul, chairman of the Federation of Thai Industries (FTI) said the Thailand Industry Sentiment Index (TISI) was 91.8 in September, up from 90.5 in the previous month.

The index has been consecutively improving for the last four months in all index components, except for the manufacturing costs. Despite the increasing index rate, the number still falls short of a “100” figure, reflecting the lack of confidence in the economy.

Factors that led to the increase of TISI, including the acceleration of economic demand, resulted from the lifting of restrictions, an emergency decree, a nationwide control, and the dissolution of the Center for COVID-19 Situation (CCSA) all of which goes hand in hand with the steadily recovering of the economy, especially in the tourism sector.

Furthermore, the consumption sector also has shown a positive sign in a slow rise owing to the financial gains of the agriculture section and the government’s economic relief plans like the 5th phase of the co-payment scheme and several energy bailout plans, all of which have actively contributed positively to the overall economic recovery.

At the same time, the manufacturing sector also showed a positive advantage in the market with the recurring trade at play and the depreciation of the baht currency that stimulates the export and tourism industries.

Despite the positives from the latest overall economic polls and updates, the confidence in manufacturing costs on the supply side is low since entrepreneurs remain concerned on the ongoing plight regarding rising energy prices such as diesel, natural gas, and electricity, as well as rising industrial material prices, which have a direct impact on operating, manufacturing, and logistical costs.

On the export side, global demand showed downward trend as the worldwide manufacturing sector has been hit by the confrontation of economic giants, the US, China, and EU , which have driven global inflation caused by the war in Ukraine and the disrupting supply shortage crisis resulting from the zero-Covid measure of the Chinese government.

A survey of 1,274 enterprises covering 45 industry clubs nationwide, conducted in September 2022, revealed concerning factors for entrepreneurs are the current global economy (77.4), domestic political landscape (45.5), and exchange rates (37.8), respectively.

On the contrary, oil prices (60.3), domestic economy (42.5), Thai baht against dollar exchange rates in exporters’ view (35.8) and the COVID-19 situation (34.2) see hope as entrepreneurs’ concerns continue to go down respectively.

TISI for the next three months is predicted to be at 101.8, increasing from 99.5 in August.

Entrepreneurs forecasted that the domestic economy will continue to see positive changes as the tourism and consumption sectors return to normal. However, the risks associated with manufacturing costs, such as an increase in the minimum wage, fluctuating oil prices, and global economic volatility, remain a source of concern

and may play a negative role in the Thai economy's recovery in 2022.

Policy recommendations to the government are, to mitigate the cost of production risks; to provide relief packages for entrepreneurs and people affected by catastrophic floods and temporary policies such as debt moratoriums or soft loans to help flood-ravaged businesses rebuild; to stabilize the Thai baht for the benefit of both importers and exporters; to put forth a campaign promoting the saving of electricity and energy; to foster Thai entrepreneurs' competitiveness; to develop for technological innovation.

13 October 2022

Viewed 281 time

EN

EN